HOW TO NAVIGATE THE RENTAL AND MULTI-FAMILY HOUSING MARKET IN LATE 2024

November 13, 2024

As we head toward 2025, the rental and multi-family housing markets are experiencing dynamic shifts that will shape the strategies of developers, investors and homebuilders alike. High-growth regions, affordability concerns and fluctuating rental prices define a landscape where supply and demand are closely tied to broader economic patterns. Here’s an in-depth look at the current state of the rental and multi-family housing markets and what it means for the industry.

REGIONAL TRENDS AND CHALLENGES

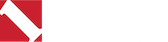

Nationally, when only looking at the monthly payment, rents have relatively stabilized over the last two years after a 30% rise in rents between 2019 and 2022, and the rent versus own equation has tilted toward renting as a result.

However, much like the single-family housing market, the multi-family market is dependent on location: some areas continue to see rent increases, while others are experiencing year-over-year declines.

Generally, markets with limited new construction, such as the Northeast, Midwest, and parts of the West Coast are seeing rents rise on a yearly basis with stable occupancy rates. In these regions, the slower pace of construction keeps demand high, with limited vacancies pushing rents upward. On the East and West Coasts, the steady rental market is largely a result of tight inventory, and in the Midwest, rents are rising more slowly but are supported by a balance between new supply and incomes, allowing for steady household formation.

Conversely, high-growth markets in the Sun Belt region—including cities like Austin, Phoenix and parts of Florida—are facing downward pressure on rents. In these areas, rapid job growth and population influx in recent years spurred substantial multi-family construction. As these projects are completed, a wave of new rental units has entered the market, surpassing demand. Unlike the single-family market, where individual homes are built gradually, multi-family units are often completed in large numbers simultaneously, creating a more immediate impact on the market. This supply increase has pushed rental prices down, with Austin seeing an 8% year-over-year drop in rent prices—a significant shift in a market once defined by rapid rent growth.

THE SUPPLY SURGE AND RISING CONCESSIONS

One of the defining characteristics of the current rental market is the surge in new multi-family completions. With new rental units hitting the market, landlords in high-growth cities are facing increased competition, leading to a rise in concessions (such as offering one month’s rent free) to attract and retain tenants. Concessions in some Sun Belt cities now average around 8% of annual rents, a stark contrast to markets with tighter rental inventories, where concessions are far less common.

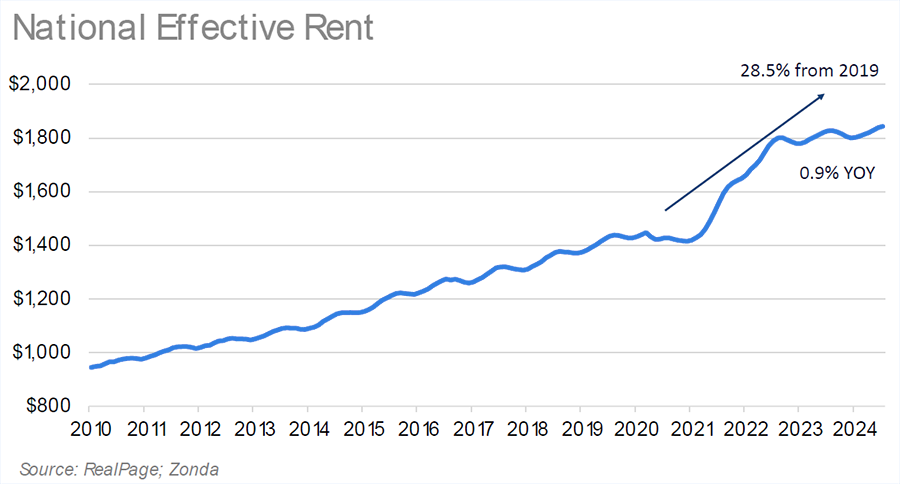

Occupancy rates, too, reveal the challenges in these high-supply areas. Nationally, occupancy has dropped from pandemic highs of nearly 98% to around 94%, a shift that is more pronounced in high-growth regions.

Some Sun Belt markets are seeing occupancy rates closer to 90-93%, which makes it difficult for landlords to raise rents. According to industry benchmarks, maintaining occupancy above 95% is crucial for achieving pricing power. Thus, without stabilizing occupancy, these markets are likely to remain competitive, with limited opportunities for rent increases in the near term.

ECONOMIC CONDITIONS AND FINANCING: MULTI-FAMILY DEVELOPERS HOLD BACK

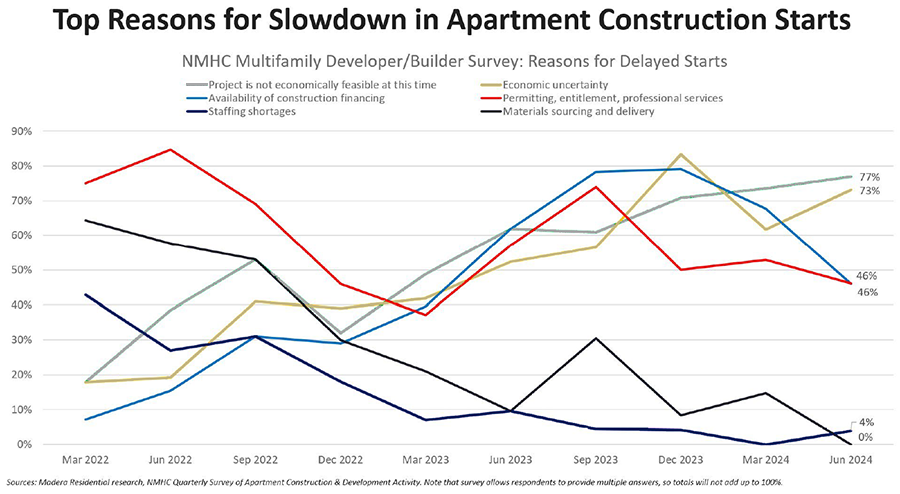

Several macroeconomic factors are tempering enthusiasm for new multi-family starts. General economic uncertainty has made construction financing difficult to come by, making projects less feasible. Developers are navigating a challenging environment: although construction inflation has slowed, material and labor costs remain elevated. High interest rates add to the costs, pushing many developers to adopt a cautious approach, holding off on new starts until conditions improve.

Additionally, delays in permitting and entitlement processes are contributing to developers' hesitation. The time and expense required for approval has increased, prolonging timelines and adding to overall project costs. This has created a feedback loop where limited new starts lead to fewer completions in future years, further influencing the availability of rental housing supply.

FORECAST FOR 2025 AND BEYOND: ANTICIPATING STABILITY AND GROWTH

While the multi-family market faces near-term headwinds, the longer-term outlook remains positive. High completion rates in 2024 and 2025 will keep pressure on rental prices and occupancy rates in some regions. Camden, a major real estate investment trust (REIT), expects multi-family starts to hover around 200,000 units in 2025, reflecting developers’ cautious stance amid high borrowing costs and uncertain economic signals.

However, beyond 2025, the rental market is expected to stabilize, with many experts, including those at Zonda, projecting a rebound in starts by 2026. By then, the backlog of previously started projects will likely have been completed, creating an opportunity for renewed growth as demand continues to rise. Kimberly Byram, a multi-family market expert, notes that for large multi-family projects initiated today, developers should expect delivery timelines extending to 2027 or later.

OPPORTUNITIES AND STRATEGIES FOR BUILDERS

For homebuilders and multi-family developers alike, understanding these trends offers a roadmap for strategic decision-making. Here are key insights for builders navigating the rental and multi-family housing market:

- Focus on Local-Specific Strategies Rental trends vary significantly by region, with Sun Belt markets requiring different approaches than the Northeast or Midwest. In high-supply markets, builders might consider flexibility in pricing and rental concessions to maintain occupancy. Conversely, in tighter markets, builders may have more room to reduce incentives and focus on quality to appeal to renters willing to pay for higher standards.

- Plan for Long-Term Gains Given the challenges in financing and construction costs, new multi-family projects require a long-term perspective. Builders may want to prioritize projects in regions with steady demand and limited new supply or focus on smaller-scale developments that can be completed more quickly and at a lower cost.

- Optimize for Occupancy As occupancy becomes a key factor in rental pricing power, builders and developers should consider tenant retention strategies. Providing community amenities, flexible lease terms and value-added services could help maintain occupancy and reduce turnover, particularly in high-growth regions where tenants have multiple options.

- Adapt to Rising Supply Costs and Financing Rates With financing and permitting challenges likely to persist, developers should engage in proactive planning, such as exploring partnerships that could share development costs and reduce risk.

The rental and multi-family markets are likely to remain challenging over the next few years, especially in regions with ample supply. However, the long-term fundamentals of the rental market remain strong, with demand expected to support growth beyond 2026. Builders and developers who adapt to these trends and plan for the future will be best positioned to thrive as the market eventually stabilizes. By balancing today’s challenges with strategic investments, the industry can navigate this evolving landscape while preparing for growth in the years to come.